flow through entity llc

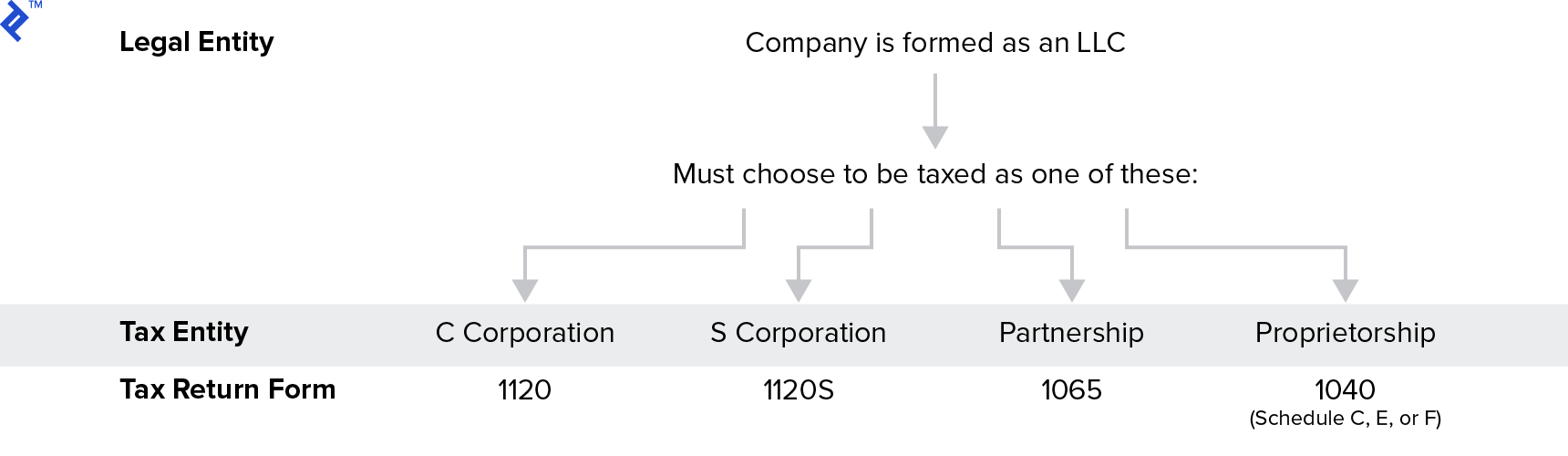

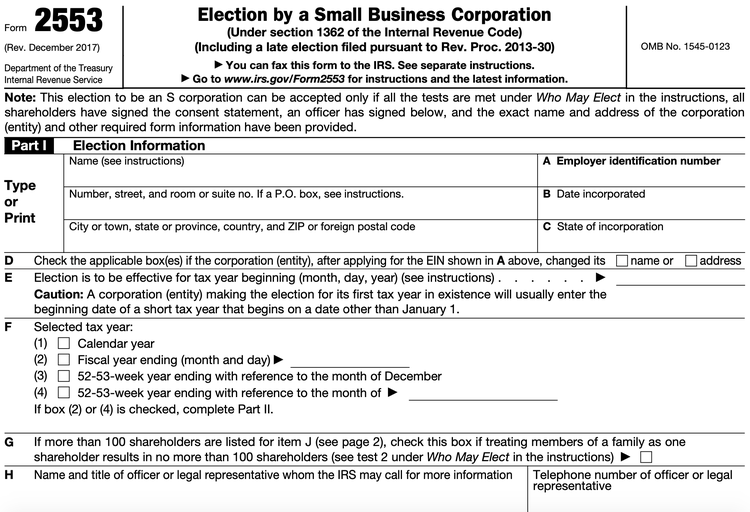

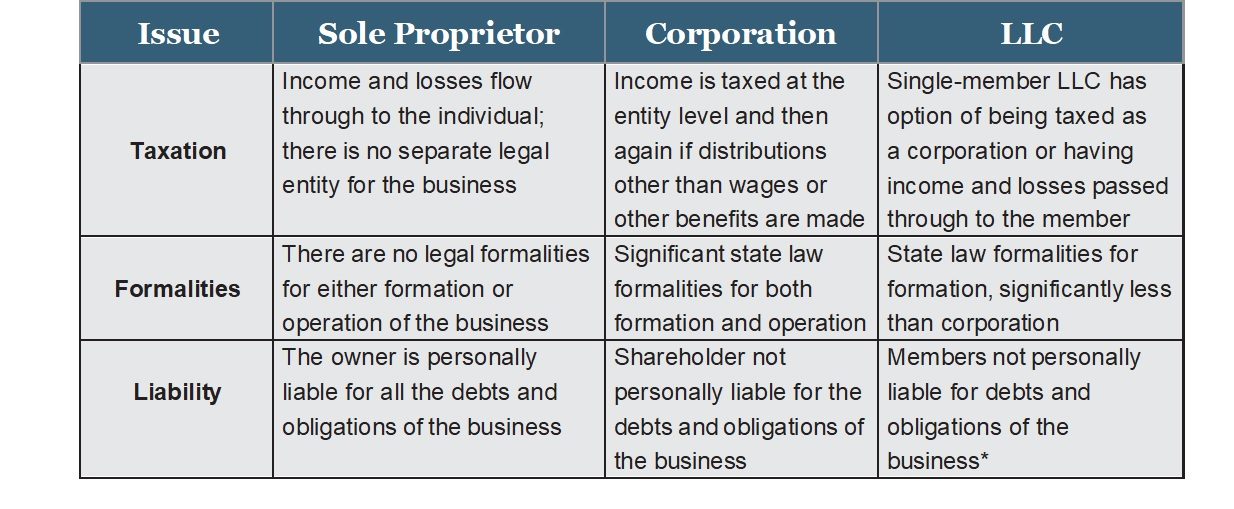

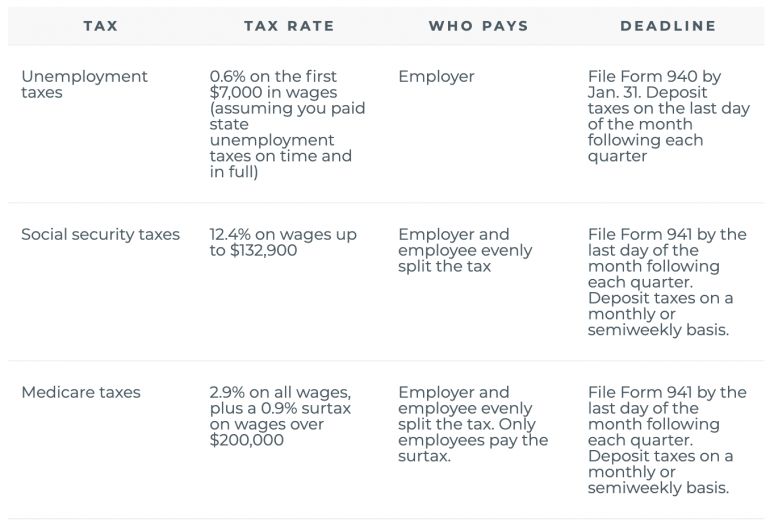

The Michigan FTE tax is levied and imposed on certain. S Corporation is a special tax status that corporations and LLCs can elect.

Partnerships Or Llc Or S Corps Or C Corps Do You Need An Itin Being A Member Of This Entity Itincaa

The profitslosses of the.

. What qualifies as a pass-through entity. There are three main types of flow-through entities. See This Term In Action.

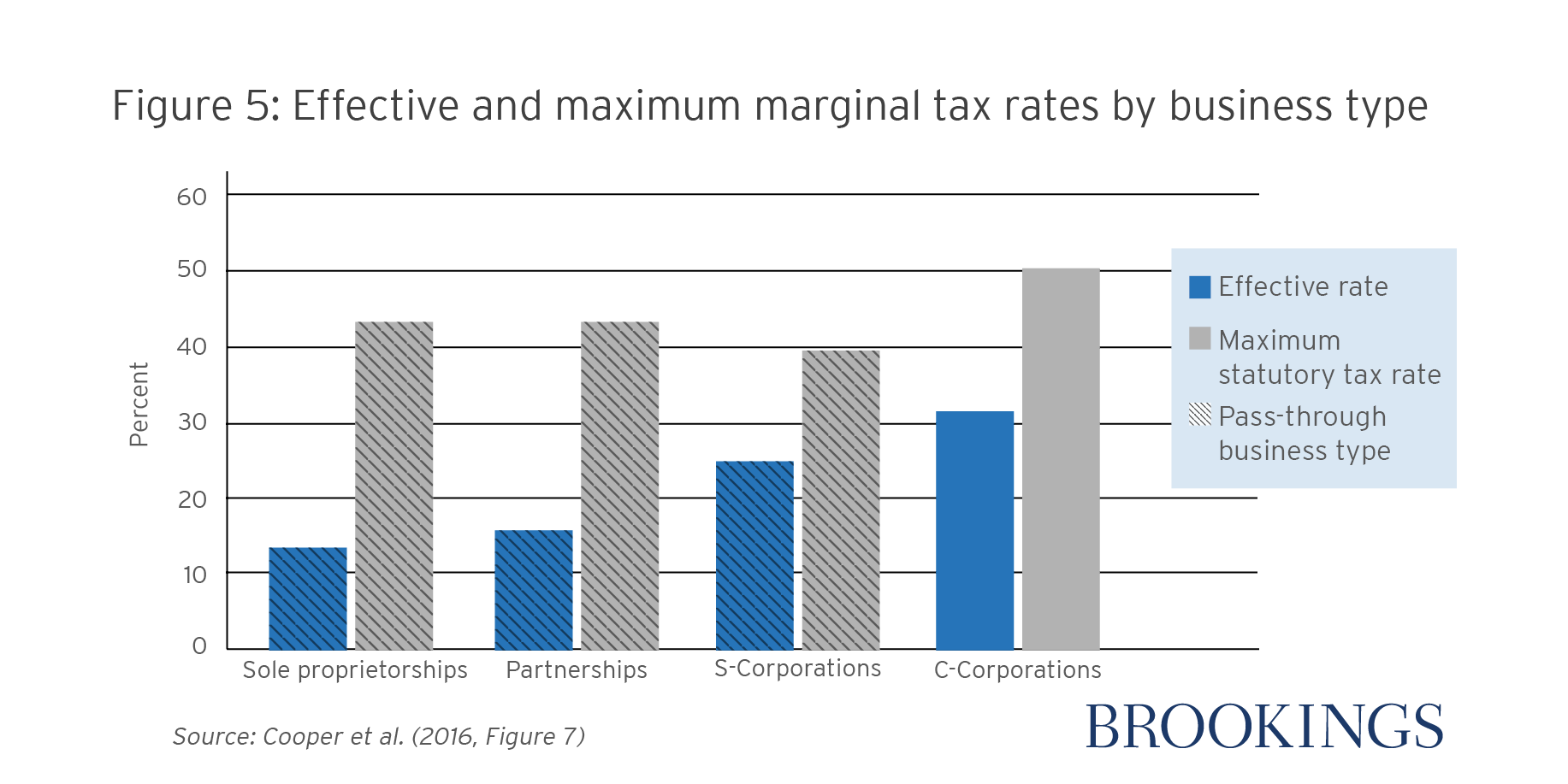

A flow-through entity is a legal entity where income flows through to investors or owners. Pass-Through Entities Both default tax structures disregarded entity and partnership undergo pass-through taxation which means that rather than paying corporate. Related Terms Glossary Definition What is a Flow-Through Entity.

Structuring the Flow-Through Entity. If the Chapter 3 payee is a disregarded entity or flow-through entity for US. They file an informational federal return Form 1120S but no income tax is paid at the corporate level.

That is the income of the entity is treated as the income of the investors or owners. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through. For this reason the LLC operates as a flow-through entity.

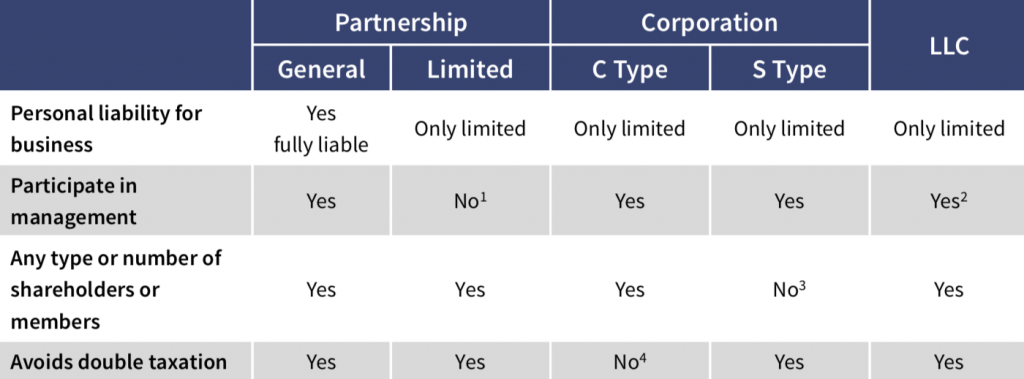

Types of flow-through entities. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are.

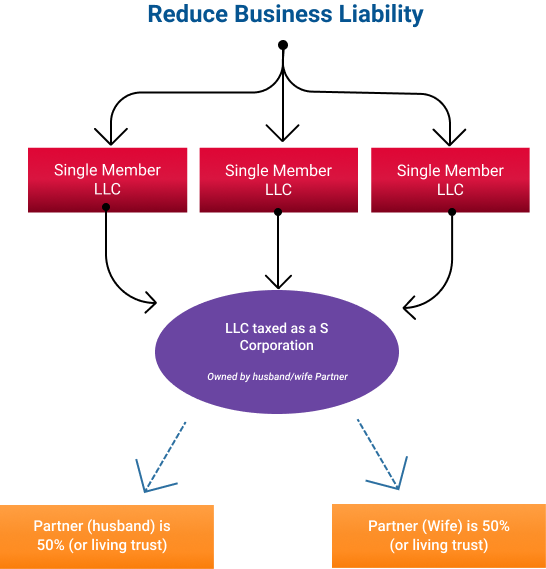

Structuring the admission of the service provider. Using qualified S corporation subsidiaries and single-member LLCs. In other words the business.

The protection of personal. A pass-through business is a sole proprietorship partnership or S. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence.

Tax purposes but the payee is claiming treaty benefits see Fiscally transparent entities claiming treaty benefits. S Corporations arent actually a separate type of business entity. A business owned and operated by a single individual.

As a result only these individualsand not. S corps are pass-through taxation entities. A pass through entity is a type of legal entity where the business profits and losses are passed through directly to the business owners.

S Corporations as Pass-Through Entities. A flow-through entity is defined as an S corporation or a partnership under the internal revenue code for federal income tax purposes. Flow Through Entities Owned by Residents of Canada.

In this legal entity income flows through to the. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. What Is Tax Planning.

This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor.

9 Facts About Pass Through Businesses

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Starting A Company Llc Vs Corporate Considerations Rubicon Law

Llc Taxation Case Study To Help Determine Best Taxation Type

9 Facts About Pass Through Businesses

A Beginner S Guide To Pass Through Entities

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

What S The Best Type Of Business Entity For Tax Purposes Kdp Llp

What Are Pass Through Businesses Tax Policy Center

Flow Through Entities Income Taxes 2018 2019 Youtube

Pass Through Entity Definition Examples Advantages Disadvantages

Which Entity Is Best For Your Business And To Protect Your Assets

Flow Through Entity Llc It Be Fun Bloggers Photo Galery

Choosing A Business Entity In The Usa Htj Tax

What Is A Pass Through Business How Is It Taxed Tax Foundation

:max_bytes(150000):strip_icc()/business-entities-3193420_final-9806a9e0701a4f60b9e06d36e0e0338b.png)